Corporate Financial Risk Management - Managing Interest Rate Expense Flows At Risk

Introduction

IntroductionCorporate financial risk management has become a hot topic over the last couple of years in light of the Global Financial Crisis (GFC) of 2007/08. The markets have changed significantly with there being a much higher level of uncertainty, more risk factors to consider, and an eve -changing regulatory environment. As a result, corporate treasuries have started to receive the board-level attention needed to allow for more optimal risk management approaches.

The optimal risk management strategy should set out specific objectives and guidelines, while properly aligning the risk management approach with core and non-core business activities. A concrete methodology should also be set to evaluate the effectiveness of the risk management strategies to continuously keep up with the changing market conditions.

Key steps to practical risk management include knowing why hedging is necessary, knowing how to hedge, and knowing when to hedge. When managing interest rate risk, it is therefore critical to understand the source of the risk, how much exposure to that risk exists, and the best way to minimize the risk. In short, three steps should be taken when assessing interest rate risk: 1. Exposure Evaluation; 2. Exposure Measurement; 3. Exposure Management.

Exposure Evaluation

The first step is the exposure evaluation phase. This includes understanding the sources of interest rate risk exposure as well as the reasons why these sources of risk may occur. There are generally three categories that make up the sources of interest rate risk exposure. Each of these categories has business-driven rationale for why these exposures exist within in a corporation:

Fixed/Floating Liabilities

- Fixed/Floating liabilities are issued to maintain and expand business operations

- Efficient way of raising capital without diluting shareholder value

- Optimizing debt/equity ratios

- Examples include fixed rate bonds, floating rate notes (FRNs)

Fixed/Floating Assets

- Fixed/Floating investments made with excess cash, normally in short-term

debt or bank deposits

- Examples include Interest Rate futures, Treasuries, Money Market Funds

Forecasted Transactions

- Meeting future corporate funding needs where capital is raised via commercial

paper, forecasted debt issuances, etc

Once a corporation evaluates the sources of interest rate risk, it is in a much better place to understand how best to measure this risk exposure. Exposure measurement is crucial for optimizing a corporations' risk management strategy as it provides a basis for how and when to hedge.

Exposure Measurement

The second step in managing interest rate exposure is the exposure measurement

phase. With interest rate risk, the main component being measured is forecasted interest

flows over the life of the exposure(s). As such, there are a few questions to ask when

performing the exposure quantification phase:

- What are the forecasted interest flows under normal market conditions?

- What are the forecasted interest flows under stressed market conditions?

- What are the forecasted interest flows are at risk in a simulated market environment

under a specified time horizon?

Let's discover measuring interest rate exposure in the form of an example:

Share:

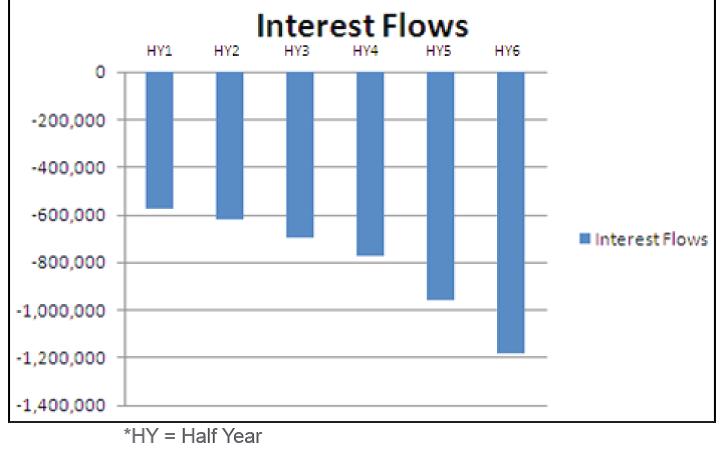

Going back to the first question, what are the forecasted semi-annual interest expense flows of this FRN based on the yield curve as of the issue date (Oct 1st 2010):

Share:

The downward sloping nature of the chart explains a healthy upward sloping yield curve, indicating the interest expense flows increase for the longer dated cash fl ows. In aggregate, the total expense fl ows over the next three year period are ~-4.8MM EUR giving the corporation an indication of what interest expense cost it should expect to incur over this period.

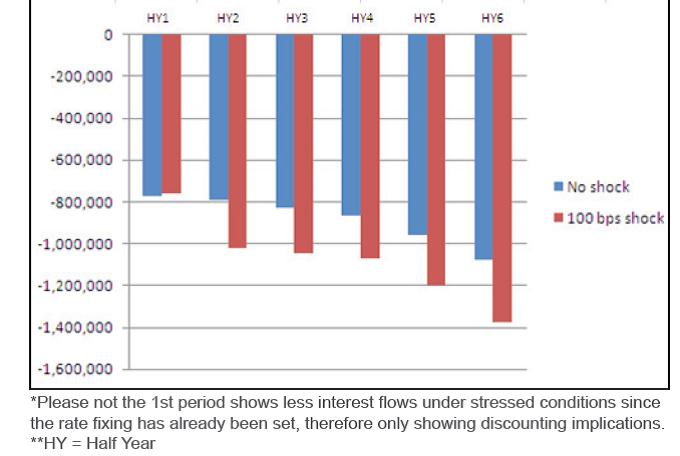

However, if the last three years of market activity is any indication of the future, the forecasted interest expense flows under current market conditions do not necessarily infer what the actual interest expense flows will be. To that end, it is crucial to assess what are the forecasted interest flows under stressed market conditions? In the below graph, there is an illustration of what the forecasted semi- annual interest expense flows will be over the next

three years assuming a parallel 100 basis points shock across the yield curve as of the issue date:

Share:

It is evident that there is a significant impact on the forecasted interest expense flows. Specifically, interest flows increase to an aggregated -7.442MM EUR from -4.8MM EUR, or ~ 65% increase from normal market conditions. As a corporate risk manager, it is essential to understand the market risk associated with the firm's interest rate exposure. As seen from the Global Financial Crisis, interest flows were not what they were originally forecasted to be under normal market conditions!

Many corporations may stop at the point of stress testing for quantifying their risk exposure. However, to ensure a corporation's risk management strategy provides a holistic view to measuring risk, it is essential to also understand what interest expense flows are at risk under a simulated environment in a specified time horizon. This leads us to the last question in quantifying risk: What are the forecasted interest flows are at risk under a simulated market environment under a specified time horizon?

A supplemental risk management tool that can be used to simulate what interest flows are at risk is running a Cash Flow at Risk (CFaR) simulation. A CFaR simulation provides a more holistic view to a corporate's interest flows at risk as it:

(1) Develops confi dence intervals on how much market risk exposure a corporation can except to have;

(2) Creates a risk profile based on multiple risk factors (i.e. FX, Interest Rate, Credit, Equities);

(3) Incorporates correlations between those risk factors;

(4) Measures the effect that the correlations have on the underlying exposure being measured.

In other words, measuring the market risk of an FRN is simply not enough. Most corporations have exposures to multiple risk factors, most of which may be correlated with the exposure being measured in question. The net result may be that the FRN has more or less interest fl ows at risk than a simple stress test assessment.

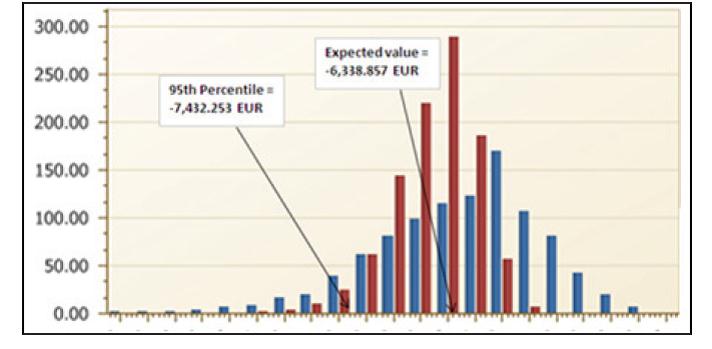

Below is a graph of a CFaR simulation of 1,001 trials illustrating the aggregated CFaR for the mean, or expected cash flow at risk, as well as for a typical worst case scenario (95th percentile):

Share:

From the chart, the aggregated cash flows at risk for the worst case scenario (95th percentile) are ~-8.116MM EUR, indicating there is a 95% chance the interest expense flows will not be more this amount over the 3 year time horizon. Taken in conjunction with the 100 bps stress test above, it is worth noting that the aggregated interest flows from the shocked yield curve are about 700K EUR lower than the 95th percentile of this CFaR simulation. The moral of this risk measurement story is that while the stress test provides a market risk assessment of the interest rate risk on a standalone basis, the CFaR model allows the risk manager to understand the affect of multiple risk factors as well as what a reasonable stress test shock is since the CFaR model provides confidence levels here indicating a 100 bps shock falls within the 95% tail indicated in the simulation above.

Exposure Management

The final step is the management and minimization of the interest rate exposure. This process can be executed in a couple of ways, whether it is an asset/liability matching exercise or hedging underlying exposure with derivative instruments. When using derivatives, it is imperative to analyze the best instrument to hedge the underlying exposure in addition to the optimal hedge coverage ratio to use.

Let's discover ways to analyze interest exposure in the form of an example:

Share:

In this example, Company ABC has decided to hedge 50% of the 100MM EUR FRN exposure with a vanilla interest rate swap. The net effect of this hedge is exposing Company ABC to 50% 6M EURIBOR interest flows and 50% fi xed interest flows at a coupon of 1.927%.

The chart below illustrates the impact on the aggregated semi-annual interest flows over the next three years under normal market conditions with that addition of the 50% IR swap coverage:

Share:

We can see from the graph that interest flows actually increase and an aggregate basis to ~-5.291MM EUR, about 500K higher than without hedging with an IR swap. This increase can be attributable to the fact that half of the interest flows are locked into a fi xed rate of 1.927%, which is actually higher than the short end of the 6M EURIBOR curve under stable market

conditions. However, in prudent risk management it is not always about minimizing risk under normal market conditions, but it is more so relevant for risk reduction to adverse market environments.

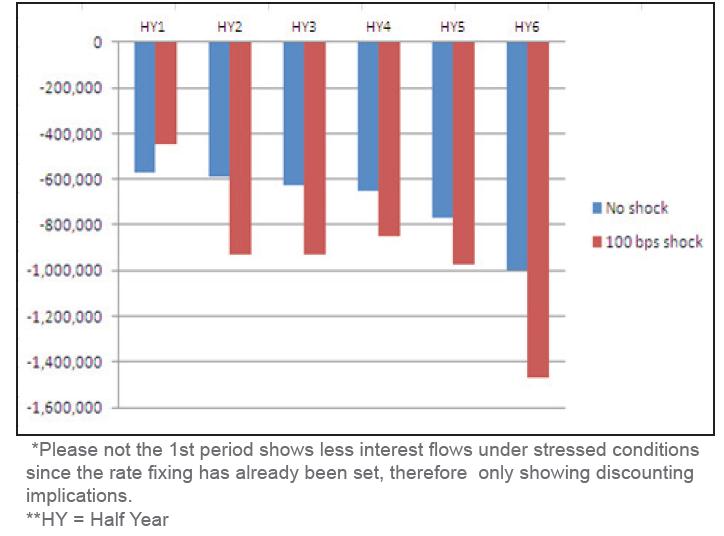

Below is a depiction of the aggregated interest flows for the FRN + 50% IR swap under stressed market conditions (100 bps shock):

Share:

The aggregate interest flows in this case are ~-6.48MM EUR, which is about a 900K EUR savings from the un-hedged FRN under stressed market conditions. This illustrates a perfect example of how the value of locking in half of the interest flows at 1.927% saves the corporation money in an adverse market environment.

The last step to effectively managing interest rate exposure is to understand the effect the 50% IR swap has on the CFaR simulation viewed above for the un-hedged FRN. Below is the chart delineation (red bars):

Share:

In this case, the aggregated interest fl ows over the next 3 years in the worst case scenario (95th percentile) are ~ -7.432MM EUR, which is ~684K EUR savings from the CFaR results from an un-hedged position. It is therefore evident that layering a 50% interest rate swap is effective in minimizing IR risk exposure in adverse market condition.

A second example that can be used to manage IR exposure is an interest rate cap option:

Share:

In this example, the corporation is 50% exposed to the fl oating rate 6M EURIBOR and 50% hedged with the interest rate cap. The cap effectively allows the corporation to incur interest expense up to 1.85% and anytime the yield curve increases beyond that (i.e. > 1.85%), the incremental difference will be paid by the bank to the corporation.

The chart below illustrates the impact on the aggregated semi-annual interest fl ows over the next three years under normal market conditions with that addition of the 50% IR cap coverage:

Share:

We can see from the graph that interest fl ows decrease on an aggregate basis to ~-4.1MM EUR, about 700K less than an un-hedged position. This decrease also illustrates the benefit of using an interest rate cap instead of an interest rate swap to hedge the FRN. Since the optionality of the cap allows the corporation to only fi x the interest rate fl ows in higher yield curve environments, the corporation still benefits from the downside effect of interest rates.

Now let's look at the chart of the aggregated interest fl ows for the FRN + 50% IR cap under stressed market conditions (100 bps shock):

Share:

The aggregate interest flows in this case are ~-5.6MM EUR, which is about a 1.8MM EUR savings from the un-hedged FRN under stressed market conditions, and a 900K EUR savings of the 50% IR swap hedge. This is yet another example of how powerful the IR cap is from a hedge standpoint and the benefi ts it provides under normal and stressed market conditions.

The final analysis to be done on the analysis of the IR cap hedge is to look at the CFaR simulation over the 3 year time period.

Share:

The worst case scenario (95% percentile) cash fl ow at risk of a 50% IR cap hedging the FRN over three years is an aggregated -6.69MM EUR. Like the stressed market condition, the CFaR was minimized as well using the IR cap hedge, this time yielding a savings of about 800K EUR over a three year period.

Conclusion

In summary, below are the results of all the scenarios discussed:

Share:

A couple observations can be made to summarize the results of each hedging strategy:

- Both the interest rate swap and interest rate cap curtail the 95th percentile "tail risk", by about 684K EUR and 1.127MM EUR, respectively.

- Even though the interest rate cap comes with an upfront premium of 1.38MM EUR, it not only minimizes the tail risk of adverse market conditions by nearly twice that of the IR swap hedge, but also minimizes the expected interest cost by about 400K EUR under expected market conditions compared to an un-hedged position.

It is now evident that the interest rate cap is the most favorable hedging strategy, as the interest expense outflows are less than the interest rate swap strategy under normal, stressed, and simulated market conditions for the reasons explained.

After evaluating, measuring, and managing the interest rate risk exposure it is clear that the optimal hedging strategy is best executed at times with favorable interest rates that will minimize total interest expense outfl ows, and it is always best to consider multiple products to create the most prudent risk management approach.

by: Reval